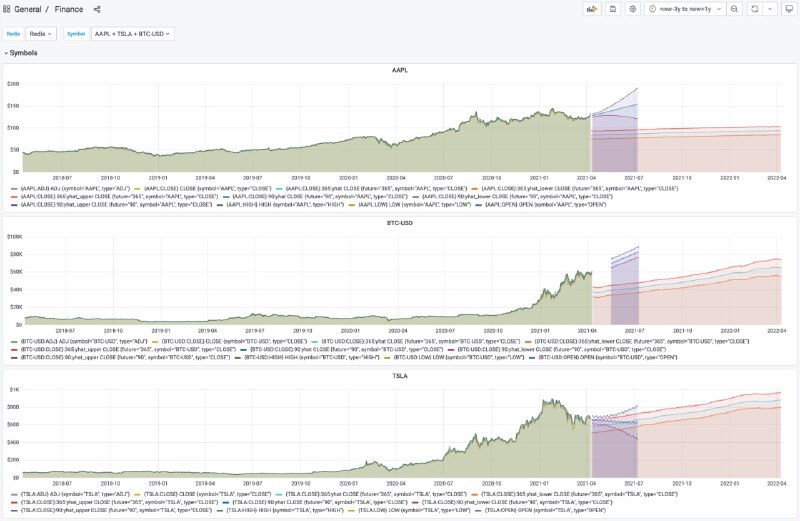

آشنایی با Grafana یکی از بهترین داشبوردها برای مصورسازی سری های زمانی - 1

یکی از بهترین ابزارهای مصور سازی دادههای سری زمانی علی الخصوص زمانی که با حجم بسیار زیاد دادهها در زمان های طولانی سروکار داریم گرافانا است. از ویژگیهای مهم گرافانا، متن باز بودن آن است و اینکه در تمام سیستم عامل ها قابل اجرا است.

#سری_زمانی

#گرافانا

#Grafana

کانال پایتون برای مالی

🆔 @python4finance

یکی از بهترین ابزارهای مصور سازی دادههای سری زمانی علی الخصوص زمانی که با حجم بسیار زیاد دادهها در زمان های طولانی سروکار داریم گرافانا است. از ویژگیهای مهم گرافانا، متن باز بودن آن است و اینکه در تمام سیستم عامل ها قابل اجرا است.

#سری_زمانی

#گرافانا

#Grafana

کانال پایتون برای مالی

🆔 @python4finance

tg-me.com/python4finance/900

Create:

Last Update:

Last Update:

آشنایی با Grafana یکی از بهترین داشبوردها برای مصورسازی سری های زمانی - 1

یکی از بهترین ابزارهای مصور سازی دادههای سری زمانی علی الخصوص زمانی که با حجم بسیار زیاد دادهها در زمان های طولانی سروکار داریم گرافانا است. از ویژگیهای مهم گرافانا، متن باز بودن آن است و اینکه در تمام سیستم عامل ها قابل اجرا است.

#سری_زمانی

#گرافانا

#Grafana

کانال پایتون برای مالی

🆔 @python4finance

یکی از بهترین ابزارهای مصور سازی دادههای سری زمانی علی الخصوص زمانی که با حجم بسیار زیاد دادهها در زمان های طولانی سروکار داریم گرافانا است. از ویژگیهای مهم گرافانا، متن باز بودن آن است و اینکه در تمام سیستم عامل ها قابل اجرا است.

#سری_زمانی

#گرافانا

#Grafana

کانال پایتون برای مالی

🆔 @python4finance

BY Python4Finance

Share with your friend now:

tg-me.com/python4finance/900