tg-me.com/aitechinstitute/200

Last Update:

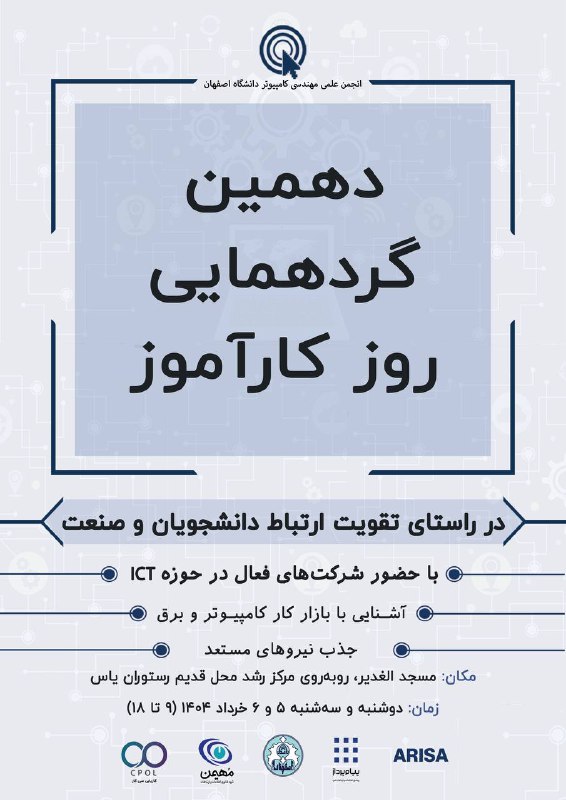

روبهروی مرکز رشد دانشگاه اصفهان،محل قدیم رستوران یاس

اینستاگرام

09120678133

03136671590

اصفهان، خیابان میر، بین پل شیخصدوق و چهارراه نظر، نبش کوچه اللهوردیخان (کوچه شماره ۷)

Location l لوکیشن

روبهروی مرکز رشد دانشگاه اصفهان،محل قدیم رستوران یاس

اینستاگرام

09120678133

03136671590

اصفهان، خیابان میر، بین پل شیخصدوق و چهارراه نظر، نبش کوچه اللهوردیخان (کوچه شماره ۷)

Location l لوکیشن

BY مرکز هوشمصنوعی آیتِک

That strategy is the acquisition of a value-priced company by a growth company. Using the growth company's higher-priced stock for the acquisition can produce outsized revenue and earnings growth. Even better is the use of cash, particularly in a growth period when financial aggressiveness is accepted and even positively viewed.he key public rationale behind this strategy is synergy - the 1+1=3 view. In many cases, synergy does occur and is valuable. However, in other cases, particularly as the strategy gains popularity, it doesn't. Joining two different organizations, workforces and cultures is a challenge. Simply putting two separate organizations together necessarily creates disruptions and conflicts that can undermine both operations.

Importantly, that investor viewpoint is not new. It cycles in when conditions are right (and vice versa). It also brings the ineffective warnings of an overpriced market with it.Looking toward a good 2022 stock market, there is no apparent reason to expect these issues to change.

telegram from id